By Dan Welch

The global electric vehicle market has continued to grow and diversify during the past year’s turbulent automotive market, according to the International Energy Agency’s annual Global EV Outlook for 2021. CALSTART and its associated Global Drive to Zero Campaign supported the research and development of the medium- and heavy-duty (MHDV) segments and are pleased to share some of the top-level takeaways for the zero-emission commercial vehicle (ZECVs, defined here as including buses, trucks, and other MHDV segments) sector. The findings below reflect the stated research from the Global EV Outlook, with graphics added from other sources to emphasize the report’s target research results.

1. ZECV models offer increasing range and availability to meet more rigorous duty cycles

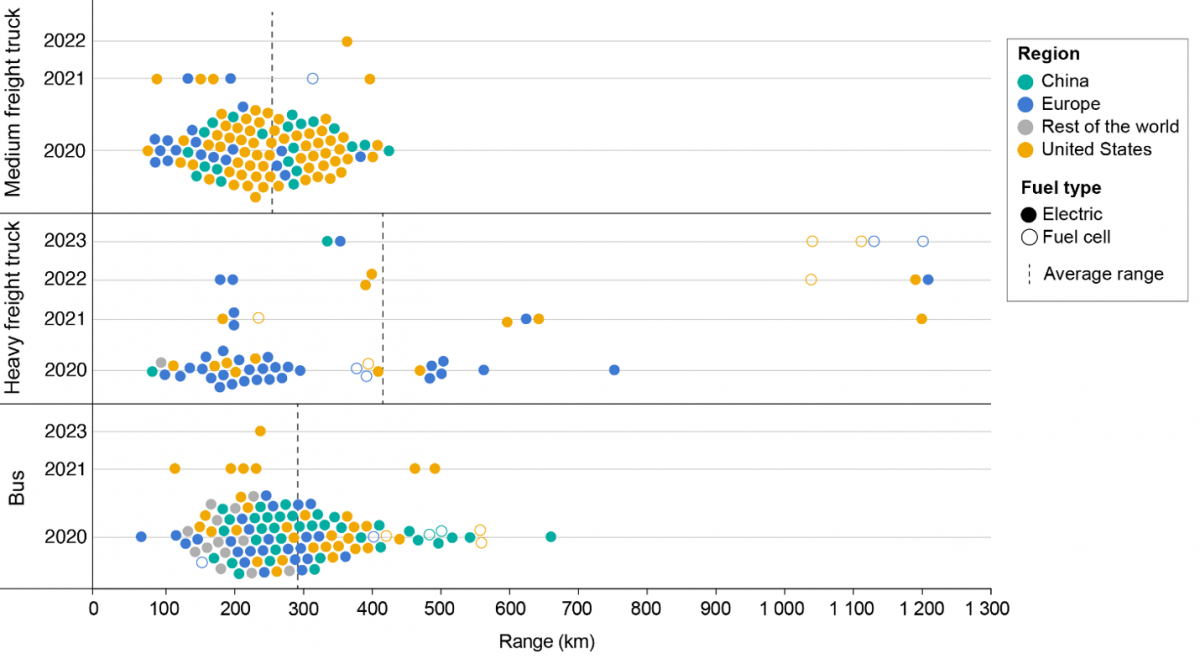

Using the Drive to Zero Campaign’s publicly available Zero Emission Technology Inventory (ZETI), the Global EV Outlook models ZECV types by range, region, and release date.

Current and announced zero-emission heavy-duty vehicles by segment, release year and powertrain (Source: IEA GEVO 2021, research from Global Drive to Zero’s Zero Emission Technology Inventory)

High-level takeaways from this ZETI-derived chart that provide context for how ZECV availability has developed and is expected to continue include:

- Range: The average range for each vehicle type, represented by the black bars, is nearly 300 kilometers, which is sufficient for nearly all vehicle applications to meet their operational requirements. Ranges are expected to grow as battery performance improves and costs reduce. Manufacturers are anticipating electric and hydrogen fuel cell truck model releases that exceed 1,000 kilometers on a single charge or refuel.

- Segment Growth: Transit buses have the greatest number of available models of any segment. This comparative surplus reflects the early market applicability of zero-emission transit buses, particularly in China, which has supported its ZECV market through national and local subsidies. As technologies improve and heavier applications approach commercialization, a greater number of truck models with longer ranges will be announced. The emergence of large traditional truck manufacturers, as evidenced through Traton’s and Daimler’s commitments to electrification, supports this expected growth.

- Association with Market Growth: Model availability is critically important to ensure a competitive marketplace that meets fleets’ diverse needs. However, model availability does not ensure market growth, and likewise a handful of models may emerge to support a robust market. The Ford Model T famously dominated the early passenger car market and supported overall sector growth. Tesla has become a ubiquitous market presence in passenger EVs with only four or five models. In the commercial sector, Rivian will produce 100,000 electric cargo vans for Amazon, but will only add one model. Though a greater number of models will broadly support the market, model availability is not directly tied to market growth.

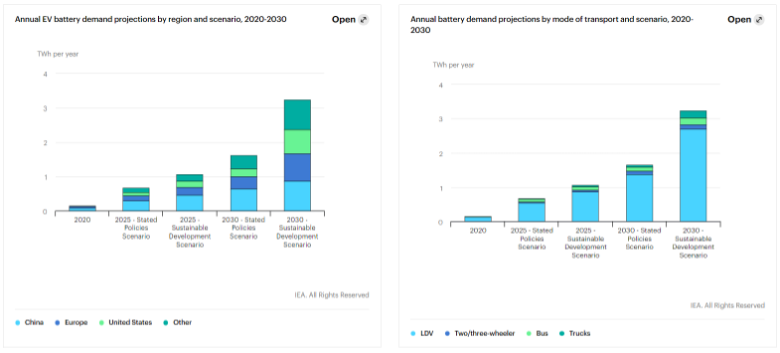

Battery demand will rise sharply to meet climate goals

A sharp increase in demand for EV batteries will accompany the planned growth in the ZECV market. Currently battery demand is greatest in the passenger vehicle segment, a trend that is expected to continue over the next decade – the IEA estimates that 85 percent of demand will derive from the passenger vehicle segment, with approximately 10 percent split between trucks and buses.

Current lithium-ion battery production capacity amounts to approximately 160 Gigawatt-hours for all vehicle types. To meet the IEA’s estimates of vehicle electrification to meet climate goals (called the Sustainable Development Scenario, or “SDS”), battery demand will rise up to 3.2 Terawatts-hours by 2030. ZECVs will account for 10 percent of the 2030 production figure at 320 Gigawatt-hours, or roughly double all current battery production.

Battery demand is currently highest in China, which is projected to remain the leader in vehicle battery demand, but the European Union and the United States are projected to nearly equal China’s demand by 2030 to meet their climate goals. The rest of the world is projected to collectively exceed the United States’ battery needs by 2030.

Current and projected vehicle battery demand by region, vehicle type, and scenario (Source: IEA GEVO 2021)

Strong federal incentives promote commercial ZEV uptake

The Chinese ZECV market, consistently responsible for more than 90 percent of the global market, has overwhelmingly led global ZECV sales. China’s market has been buoyed by expansive national subsidies that have reduced the purchase price of electric trucks and buses, which are typically more expensive to purchase than fossil fuel-powered equivalents. The national subsidy, which is often augmented by local governments, is tied to the size of the battery, providing flexibility for fleets to affordably purchase vehicles with enough battery range to meet their operational needs. The Chinese ZECV subsidy was established in 2013, revised in 2016 to scale down completely by 2020, and then extended in 2020 for several more years. The graphic below demonstrates the success of the Chinese market relative to other regions and the potential impact that the subsidy had in growing the market, as well as the depressing impact on sales of reducing the vehicle subsidy after 2016.

Historic electric bus and truck registrations by year and region (Source: IEA GEVO 2021)

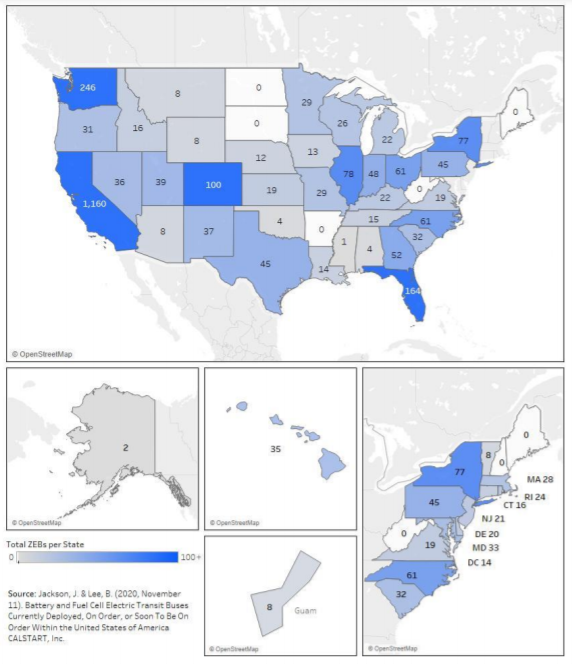

Sub-national governments can drive ZECV sales

National programs, such as China’s subsidy, provide clear market signals and for manufacturers and fleets and may be effective drivers of ZECV sales. Absent strong national programs, however, states and provinces can and are effectively supporting the transition to ZECVs. California provides an excellent example because this state has also reduced upfront ZECV costs its innovative Hybrid and Zero-Emission Voucher Incentive Program (HVIP), which uses point-of-sale rebates to reduce the incremental costs of higher-cost clean commercial vehicle technologies. This program (which is reopening on June 8 for new voucher requests) has allocated over $120 million to support ZECV deployments, most notably for transit buses, which are typically considered one of the most successful early-market commercial applications for electric drivetrains. California was the first state to offer such an incentive and remains one of the only states to do so – accordingly, transit bus sales are notably higher in California than in other states, accounting for 41.6 percent of all zero-emission U.S. transit bus orders at the end of 2020.

Current or On-Order Zero-Emission Transit Bus Deployments by State as of December 2020 (Source: CALSTART’S

Zeroing in on ZEBs)

California is leading ZECV uptake through several additional programs, including:

- The Advanced Clean Truck regulation that requires manufacturers to sell ZEVs as percentage of total vehicle sales;

- The Innovative Clean Transit regulation requires public transit agencies to purchase only ZE buses by 2029 to achieve fully zero-emission fleets by 2040;

- The Low Carbon Fuel Standard is both a regulation that reduces carbon content of fuels and incentive that rewards producers and end-users of low-carbon fuels, such as electricity; and

- The EnergIIZE program that will invest $50 million in commercial MHDV charging programs.

Other states are also supporting the transition to ZECVs, such as the 14 other states that have signed on to a Memorandum of Understanding to accelerate ZECV deployments. The states are collaborating to develop best practices and policies to achieve their deployment goals, which have been set at 30 percent zero-emission new commercial vehicle registrations by 2030 and 100 percent by 2050.

National ZECV efforts reflect differing strategies and targets

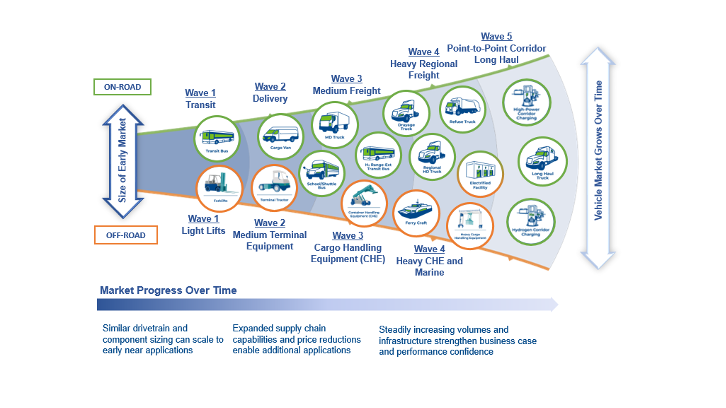

The typical trend for on-road ZECV deployment follows a strategy of first-success applications, starting with transit buses and using the same components and supply chains to support successive vehicle applications, such as cargo vans and medium-duty trucks. Commercialization typically follows a pathway, as shown below in the Global Drive to Zero’s “beachhead model” of successive vehicle applications.

The Beachhead Model of Successive Zero-Emission Commercial Vehicle Applications (Source: Global Drive to Zero’s Beachhead Model)

This commercialization pathway is evident in some of the larger efforts that markets in the earlier stages of commercialization have announced.

- The Canadian government will invest CA$ 2.75 billion in the next 5 years to electrify transit buses and school buses across the nation.

- South American electric bus leaders Chile and Colombia each established national targets to electrify their bus fleet by 2040 and 2035, respectively.

- India’s FAME II program will invest in a suite of electrified transportation technologies, including a budget for 7,000 transit buses with associated infrastructure.

- Japan’s government has committed to developing a hydrogen-powered economy with an initial target of producing 1,200 hydrogen fuel cell urban transit buses.

Some national governments are supporting ZECV deployments through a range of incentives and regulations. In Europe, for example:

- Several nations, notably Italy, Germany, Spain, and France, have established purchase incentives for qualifying ZECVs ranging from €9,000 to €50,000. These incentives differ based on vehicle applications and capabilities.

- The Netherlands has created a unique program that will establish medium-sized zero-emission delivery zones in up to 40 of its largest cities by 2025.

- Germany and Switzerland have established annual environmental road taxes that incentivize fleets to save money by switching away from fossil fuel-powered vehicles to ZECVs.

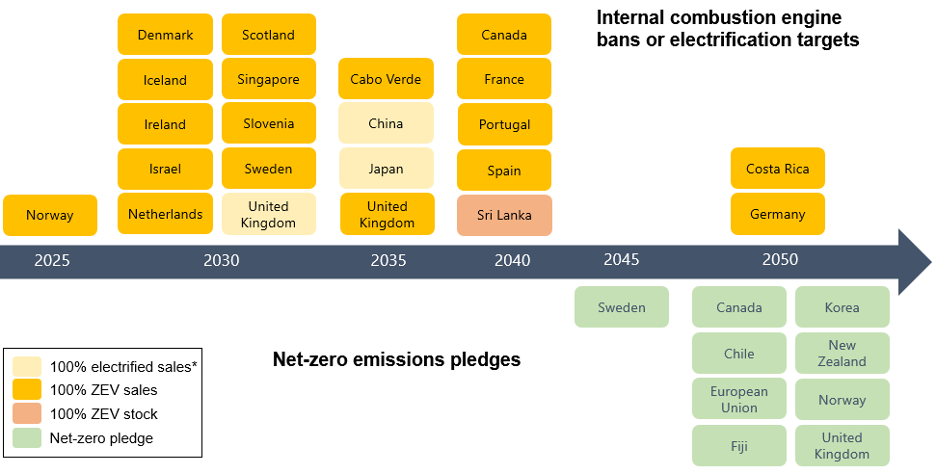

The diversity of approaches to achieving cleaner, low-carbon transportation is evident in the IEA’s compilation of zero-emission targets and internal combustion bans. More than 20 countries have announced full international combustion bans and eight (and the European Union) have pledged to achieve net-zero emissions. Several other nations, including Japan and China, have indicated that they plan to set similar targets, but they have not yet been set in legislation.

Internal combustion engine bans, electrification targets and net zero emissions pledges (source: IEA GEVO 2021)